Cyber Due Diligence for Private Equity Transactions

Cyber due diligence powered by OSINT gives you visibility into acquisition targets and portfolio companies. Identify credential exposure, breach history, and attack surface risks before they become your problem.

Book a 15-Minute CallWhy Cyber Due Diligence Matters in Private Equity

Cyber due diligence has become essential for private equity firms. Five years ago, analyzing cybersecurity strength was a low priority in M&A. Today, a single undisclosed breach can destroy deal value and expose your fund to regulatory liability.

Traditional due diligence misses what attackers see: leaked credentials on the dark web, active infostealer infections, exposed remote access infrastructure, and misconfigured cloud assets.

How PE Firms Use Cyber Due Diligence

External reconnaissance throughout the deal lifecycle and portfolio management

Pre-LOI Screening

Passive OSINT assessment before signing. Identify red flags early without alerting the target. Surface credential leaks, breach history, and attack surface exposure.

Deal Due Diligence

Comprehensive cyber due diligence during exclusivity. Quantify remediation costs, inform valuation adjustments, and identify issues for reps & warranties.

Portfolio Monitoring

Continuous external monitoring of portfolio companies. Track security posture changes, new exposures, and emerging risks across your holdings.

OSINT Intelligence We Surface

The same reconnaissance threat actors perform on your targets

Credential Exposure

Employee credentials in breach databases and infostealer logs. Session tokens that bypass MFA. Password reuse patterns across the organization.

Deal RiskInfostealer Infections

Active malware infections harvesting credentials and session cookies. Indicators of compromised endpoints within the target organization.

Critical FindingBreach History

Past security incidents, ransomware attacks, and data leaks. Threat actor attribution and timeline. Undisclosed incidents surfaced through dark web intelligence.

Disclosure RiskAttack Surface

External-facing assets, shadow IT, exposed services. Known vulnerabilities (CVEs) on internet-facing infrastructure. Misconfigured cloud resources.

Technical RiskEmail Security

SPF, DKIM, DMARC configuration analysis. Spoofing and phishing vulnerability assessment. BEC risk indicators.

Fraud RiskThird-Party Risk

Vendor relationships identified through DNS and certificate analysis. Supply chain exposure through connected services and integrations.

Supply ChainTarget: Acme Manufacturing LLC

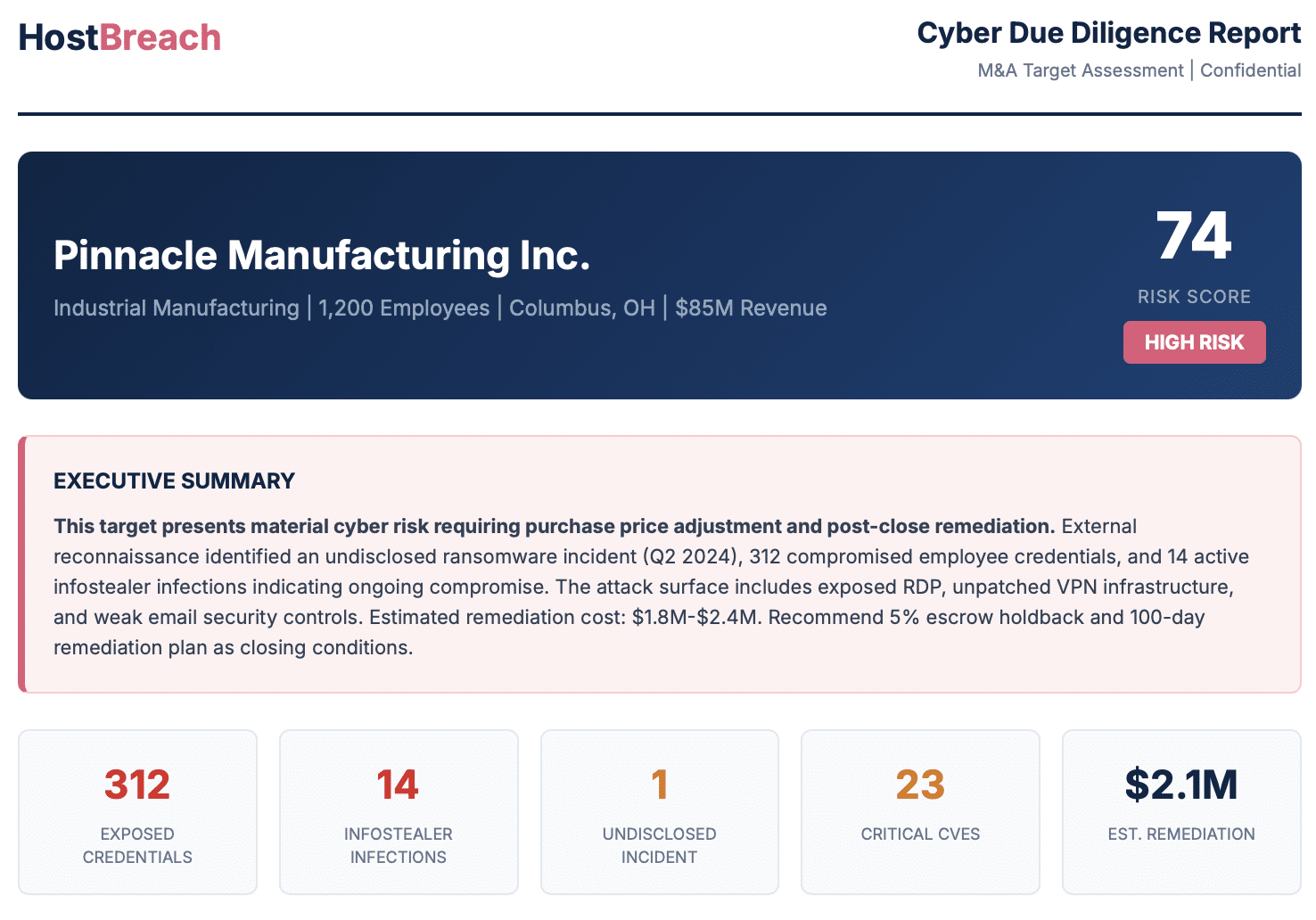

Risk: HIGHKey Finding: Undisclosed ransomware incident Q2 2024. Active infostealer infections indicate ongoing compromise. Recommend purchase price adjustment and escrow holdback.

Actionable Intelligence for Deal Teams

Our reports go beyond checkbox assessments. You get quantified risk findings that inform deal structure, valuation, and post-close remediation planning.

- ✓ Risk-scored findings mapped to financial impact

- ✓ Remediation cost estimates for purchase price negotiation

- ✓ Undisclosed incident discovery for reps & warranties

- ✓ 100-day remediation roadmap for post-close execution

- ✓ Board-ready executive summary for IC presentation

De-Risk Your Next Transaction

Get OSINT-powered risk intelligence on your acquisition targets before you sign. Assessments that surface what traditional DD misses.